I just sold this 1 1/2 storey home at 1930 Crescent Road, Victoria, BC Oak Bay.

View this recently sold 1 1/2 storey home or see all my home sales.

This photo is of Gonzales Beach which is located across the street from this property.

I just sold this 1 1/2 storey home at 1930 Crescent Road, Victoria, BC Oak Bay.

View this recently sold 1 1/2 storey home or see all my home sales.

This photo is of Gonzales Beach which is located across the street from this property.

Just uploading this House for sale, 1004 Kentwood Place, Victoria, BC

Broadmead is a popular area. This 1984 home was professionally renovated with a 18x15 addition (eight - nine foot ceiling) overlooking a private and peaceful rear yard. The flagstone pathway leads to the patio area as well as the cute shed. This pristine private home is located on a cul-de-sac with Broadmead Village Shopping only a few minutes away. Large master bedroom suite with balcony. The updated en-suite offers a 4x7 (approximately) synthetic marble shower base and seat. Glass shower surround... no need for a door. Main Bathroom offers two sinks, soaker tub/shower. A bright beautiful home with twelve skylights throughout, many large windows, two fireplaces, three bathrooms, three bedrooms, new roof in 2007. Tile Entry, Oak Floors and Plush Carpet. Window Coverings, Sprinkler System. Two separate electric garage doors.

Very Happy Seller. She is now living in Oak Bay and loving it. I just sold her Condo at 305 608 Fairway Avenue, Langford, British Columbia.

View this recently sold Condo or see all my home sales

'Welcome to Oak Bay' A Flower Centerpiece located at the corner of Foul Bay Road and Oak Bay Avenue

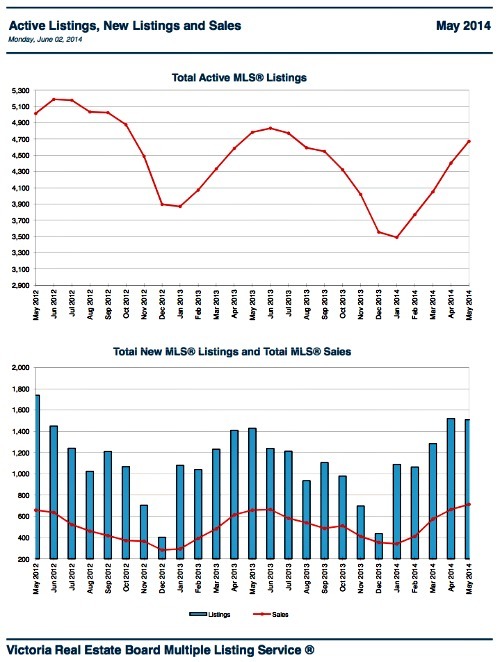

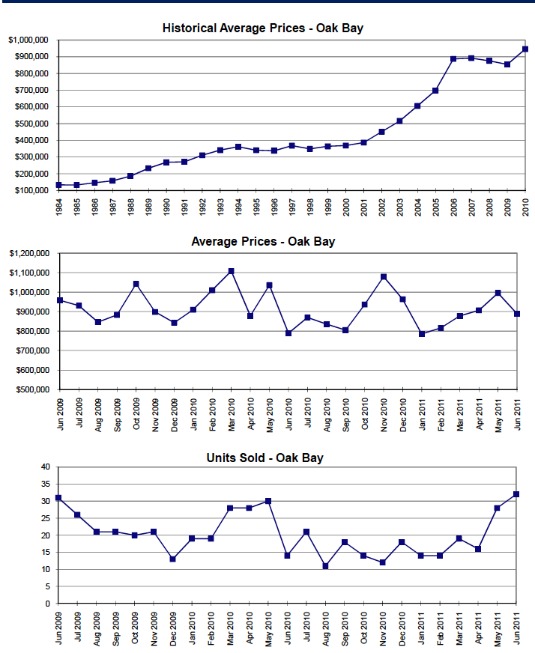

There has been an increase in the number of sales from April to May which is pretty normal. Year over year there was an increase of over 8 percent in properties sold in the region.

This year in May the benchmark home value reached $498,500. A modest 1 percent increase year over year. Townhomes in Greater Victoria show the most noteworthy change with an increase of 4.2 percent year over year.

On a personal note, I would like to appologize for not keeping the 'Market Update' page current. Six family/friends passed on in the last year and half which included my grandma and best friend within 4 months of each other... life... shortly after I realized I wasn't ready and able to provide the best service for my clients. I decided to travel to Bali, a high school friend from Oak Bay married and has a family in Ubud. I am so thankful to them for inviting me. Learned lots and experienced yoga for the first time at 'Yoga Barn' which was incredible. Experienced Tibetan bowl meditations, Sound Medicine meditations the Ayurvedic rejuvenation centre and had the best massage. Walked with chickens and roosters. Ate and sat with lots of different ants. Woke up to dogs barking, cows, and birds sings...hahahaha

In the end what matters most is

How well did you live

How well did you love

How well did you learn to let go.

Returned refreshed and now working hard. I need your business...smile... If you have any questions about Victoria real esate or are thinking of Selling your home please call me direct at 250.744.4556. Licenced since 1990, happy to help and look forward to it. Wishing you a Happy, healthy summer. Please stay tuned for more updates.

Below is a photo from Yoga Barn - Ubud, Bali Budda

I just sold this luxury House at 1915 Quixote Lane, Fairfield Victoria, BC. This truly is a unique and outstanding home that will inspire unique Christmases and birthday's for the new buyer's. View this recently sold House or see all my home sales.

UNITED STATES. Phoenix real estate rises with Canadian buyers. Bob Major returned to Phoenix in October in search of more bargains like the four empty houses he purcahsed in 2010. The retired builder from Vancouver instead found real estate about 20 per cent higher and stiff competition. "There's been an extreme turn" Major, 66, said in an interview at a Chandler, Arizona pizzeria, sitting beside his wife, Wendy. "We put bids on thirty properties and only got two." The Phoenix housing market, down 55 per cent from peak values with more than two-thirds of borrowers owing more than their properties are worth, is starting to recover as demand grows and inventory shrinks. Sales rose in November for the 12th straight month on a year-over-year bases, and distressed real estate accounted for the smallest share of purchases since 2008, according from research from DataQuick. Low prices attracted flocks of Canadians taking advantage of 28 percent currency gain versus the U.S. dollar since March 2009--and winters with an average high of 19 degrees Celsius. Canadian edged out of Californians last year as the largest group of outside buyers, with 4.2 percent of purchases.

AUSTRALIA'S love affair with property is about to be tested. Right now is not a time to be buying real estate in Australia. Residential prices are likely to fall up to 60 per cent, possibly even more, within five years. Artificially

low interest rates, high loan-to-value lending practices, overinflated

property prices, unrealistic vendor expectations and Australia's large

number of second mortgages. Prices will be on a slippery

slope next year when interest rates begin to rise, commodity prices peak

and China's demand for Australian exports slows. US economist Harry Dent recently said Australian house prices were 50 per cent overvalued. Sydney real estate agent Charlie Bailey of Ray White Inner West believes there will not be a burst because there is no bubble. "In Sydney, we have 20,000 people a week looking for accommodation and not enough supply. “I

can't see the city's housing infrastructure changing any time soon so a

prediction of a 60 per cent fall in property prices is a big call." In

recent years, Australian cities have experienced Vancouver-style real

estate booms, with housing prices soaring from Sydney to Melbourne. Like

Vancouver, buyers from China help drive Australia’s speculative real

estate market. Faced with mounting public pressure, in 2010 the Kevin

Rudd government introduced strict regulation aimed at foreign ownership.

Under the new rules, the Foreign Investment Review Board (FIRB) screens

foreigners (including temporary residents and students) to determine

their land purchase eligibility. Foreigners can’t buy existing

properties and must build on vacant land within two years of purchase or

face government-ordered sale. Scofflaws face capital gains

confiscation. Finally, before foreign homeowners leave Australia, they

must sell.

CHINA’S Evergrande Real Estate Group Ltd, the second-biggest developer in China by sales value, on Monday forecast flat 2012 sales and said the wider property market would be gloomy in the first quarter, with no improvement until after the Lunar New Year in late January. The developer and many of its peers reported sharp double-digit annual drops in sales in December as the mainland Chinese property market felt the pinch from the central government’s efforts to lower home prices and restrict property purchases. Annual growth in real-estate investment in China, a main driver of the economy, slowed in December to its lowest pace in a year, falling in tandem with property sales revenues, but analysts predict the worst is yet to come. A Reuter’s poll last week showed that analysts expect average home prices in China to fall between 10 and 20 percent this year, with the biggest declines in major cities such as Beijing as well as highly speculative markets of Ordos and Wenzhou.

Canada’s real estate market is growing at a snail’s pace, reinforcing hopes the housing sector will glide to a soft landing instead of crashing. There are two key concerns hanging over the housing market: the level of real estate prices in Vancouver and the condominium construction boom. Neither of those markets has shown signs of a catastrophic decline, even though some people have been predicting it for years.

VANCOUVER is starting to feel the effects of a slowing real estate market on its overall economy, despite continued population and job growth. The city continues to enjoy above average population growth, while the pace of job creation and level of employment quality are well above the national average. While improving recently, the unemployment rate is relatively high, just one tick below the national average, while the pace of real estate activity is starting to slow.

VICTORIA. With all the doom and gloom we hear about one may wonder how real esate and the Victoria economy in general is doing. Victoria and Victoria Real Estate have always held up pretty good compared to the rest of the contry. A recent article in the Times Colonist by Andrew A. Duffy reads: Though the city has seen its economic momentum slow. Victoria's diversified economy has insulated it from feeling the brunt of the global financial slowdown, according to a report from CIBC World Markets. The Metrolpolitan Economic Activity Index showed Victoria with a score of 13.6 ranked seventh among 24 Canadian cities, sandwiched between Calgary at 13.9 and Kitchener, ON, at 13.2. "The momentum in Victoria is starting to slow down, but the level of activity in Victoria is still relatively OK," said Menjamin Tal, senior economist at CIBC World Markets. "It says to me that Victoria has been able to maintain its position for a while now without losing big momentum, and that reflects clearly it has a fairly diversified economy and is not a slave to the value of the dollar or oil prices."

Beijing: The most expensive apartment ever built in the country. The luxury penthouse apartment of more than 1,000 sq m is on sale for Rmb300,000 per sq m, or a total price tage of more than Rmb300m ($46.2m), according to an unnamed representative of the developer.

Stable Past- Stable Future

January 22, 2012

Prepared by Jim McNaught

President of Pacwest International Management Inc.

What truly sets the Greater Victoria region apart is its unique combination of economic opportunity and its superior quality of life. Entrepreneurs with ventures of all sizes comprise more than 17,000 businesses in the region. Technology, tourism, marine, health and service industries are all thriving sectors, and the region has become a world leader in environmental services and technologies, with world-class research activities in the field.

Advantage

Victoria

As Canadians enter 2012, a report from the BMO Retirement Institute - Where do Canadian plan to retire, and why? - has found that Victoria, British Columbia is Canada's hottest retirement destination for Boomers.

According to the study, conducted by Leger Marketing for the BMO Retirement Institute, Canadian Boomers chose Victoria, B.C. as the number one spot to retire within Canada (15 per cent). "With its mild climate, breathtaking scenery and outdoor lifestyle, it's no wonder that so many Canadian Boomers have chosen Victoria as the ideal place to retire," said Tina Di Vito, Head of the BMO Retirement Institute. "Additionally, a good portion of Victoria's population is over 65 years of age and there's a strong health care network in the region; this adds to its appeal for Canadians considering relocating upon retirement.“ Source BMO Jan 4, 2012

According to the Canada Mortgage and Housing Corporation's (CMHC's) Fall Victoria Housing Market Outlook Report, the level of new residential construction activity in the Victoria Census Metropolitan Area (CMA) will total 1,700 housing starts in 2011, and edge up to 1,850 housing starts in 2012.

"Numerous

multi-family projects are currently flowing through the construction pipeline

(this includes the planning and development approvals stages) across the CMA.

Multi-family construction activity will remain consistent with the ten-year

average for the CMA," said Travis Archibald, CMHC Senior Market Analyst,

"while competition from a well-supplied resale market is expected to keep

single-detached housing starts below their historical average both this year

and next."

PacWest International

Since 1985

Government and Corporate

China-United States-Europe-

By Referral Only

Commercial & Residential Real

Business Education Programs

Country Research & Analysis

Natural Resources & Tourism

Immigration & Citizenship

Economic Development

Hotel Consulting

Health Care

Wishing you all the best in which ever way you celebrate the Winter Solstice. "With all the strains and worries and fears of the today's world our ultimate saving grace is that we're human beings and we have each other."

Located in the Fairfield area of Victoria, I just sold this House at 418 Arnold Avenue.

View this recently sold House or see all my home sales.

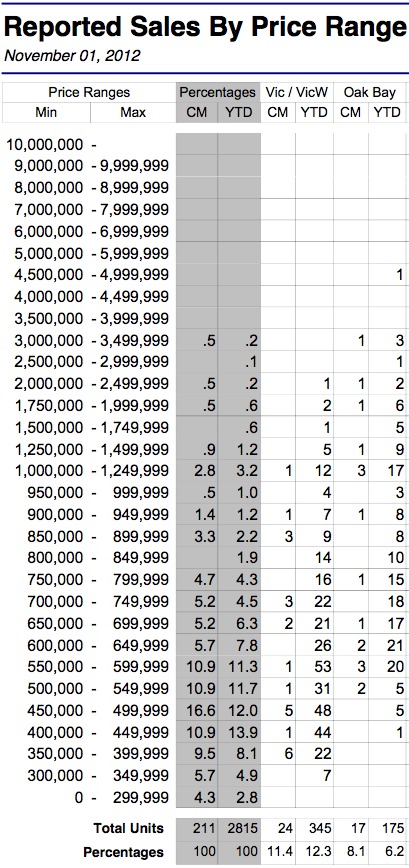

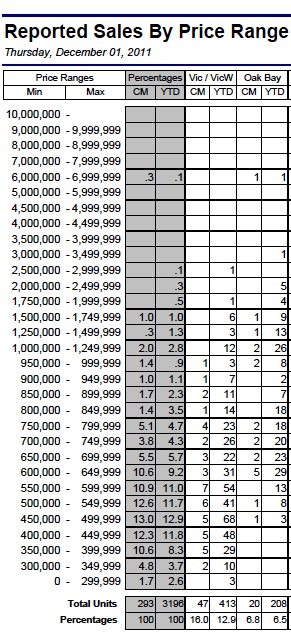

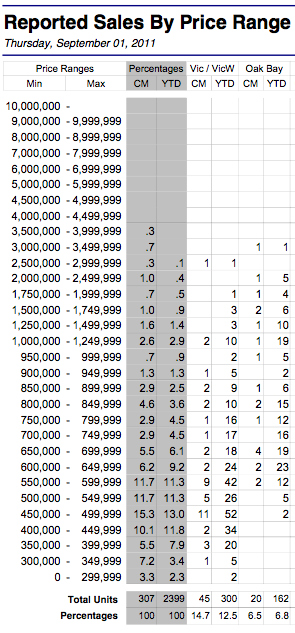

Below is a graph from the Victoria Real Estate Board showing all the Single Family Dwellings sold in the Victoria and Oak Bay areas by Price Range. For example in the Victoria area the most expensive home sold as of September 1, 2011 was just below $3 Million. I find this graph useful to see where the activity is in various price ranges. I hope it may be helpful to you as well. Please stay tuned for more real estate updates!

A strong loonie and depressed U.S. real estate prices have led to a buying binge south of the border by Canadians. Canadian's are now the largest non-American buyers of U.S. real estate. Many purchasers, however, have only a vague idea of what they've committed to from a tax and legal standpoint. "There's a presumption among people that the laws must be the same in the U.S. and Canada. A lot find out otherwise only after they buy," said David Altro, a Montreal lawyer who also practices in the United States. Altro, who specializes in cross-border tax, property and estate-planning issues, is the author of a 2009 guidebook titled Owning U.S. Property the Canadian Way. An updated version of the book is on the way because of significant changes looming in U.S. estate tax, starting in 2013. Altro said those changes will be "expensive and onerous" to many Canadians if they don't do their homework and/or get advice.

Starting Jan. 1, 2013, the exemption level on estate tax for owners of U.S. property drops to $1 million in worldwide assets from $5 million, and the maximum tax rate on U.S. property rises to 55 per cent from 35 per cent. Although the threshold may still seem high, Canadians must include in the calculation the value of their RRSPs and life insurance payable at death, which pushes a lot more people into the tax zone.

Estate tax isn't the only significant difference between the two countries. Florida counties have probate rules that could cause a lengthy delay and expensive disbursement to settle the estate of a Canadian who dies owning property there. If a property owner becomes mentally incapacitated, no transaction is possible until Florida's guardianship requirements have been met. "A Quebec incapacity mandate often isn't valid in Florida," Altro noted.

Nor does Florida recognize handwritten holographic wills, as Quebec does.

Canadians who give U.S. property to relatives are liable for U.S. gift tax as well as Canadian capital-gains tax (determined using the fair market value). Adding your children to the title also could put you on the hook for a taxable gift, and leave the property vulnerable to seizure if the children have marital or financial problems. Altro said one way for Canadians with significant property to minimize hassles, taxes and property transitions is to create a cross-border trust, with one or more people as trustees. "The trust doesn't die when the person does, so you can avoid estate tax," he said. Having a corporation own U.S. property isn't usually a good idea, he said, since the U.S. capital-gains tax is higher for corporations; states such as Florida can tack on an additional levy of their own, and the Canada Revenue Agency may charge a "shareholder benefit tax" to those who make use of outside property owned by a corporation.

Altro says tax and estate planning is always best done beforehand to avoid complications and surprises. So before signing for that Florida condo, make sure you know where you stand.

I hope you find this helpful. Once in a while I post information that is sent to me from the President of PacWest International Management, Mr. Jim MacNaught. Please stay tuned for more real estate updates...

PacWest International

Since 1985

Government and Corporate

China-United States-Europe-

By Referral Only

Commercial & Residential Real

Business Education Programs

Country Research & Analysis

Natural Resources & Tourism

Immigration & Citizenship

Economic Development

Hotel Consulting

Health Care

International Head Office

250-7580 River Road

Richmond, BC Canada V6X 1X6

James McNaught, MBA, President

I just finished uploading this House for sale, 418 Arnold Avenue, Victoria, BC

This Fairfield home was built in 1945, a two bedroom/two bath Craftsman Home has already stood the test of time and proven itself strong, square and worthy. Lovely woods throughout and fabulous oak floors. Gas appliances, a working fireplace, cared for with taste and style; if elegance is simplicity then this is the perfect example. Even a delightful, retro rec-room downstairs with sliding glass doors leading out to a side deck and the huge, sun-filled back yard and garden. And what a garden; tilled and loam rich and a great producer of all your favorite vegetables and berries. Sit in the sun, play with the kids and watch your garden grow. And when you do have to leave the grounds, the world is a short walk away because this is the most convenient neighborhood in the city. Seriously, the beach is three blocks away, Thrifty Foods is a block, every bus route runs nearby, five parks are less than ten minutes away. The Lieutenant Governor's Residence abuts the backyard and you gotta figure they know a good neighborhood, right? The photos give you an idea. Get out of the craziness for a bit and be charmed by the sanity of this lovely home.

Just a Sampling of Fairfield Plaza

I just sold this Fairfield House located in at 610 Normanton Court, Victoria, BC.

View this recently sold House or see all my home sales.

Your Trusted Partner in Real Estate. Contact me at 250.744.4556 for all your property needs.

Mobile: 250.744.4556

brenda@brendarussell.ca

Royal LePage Coast Capital Realty

108-1841 Oak Bay Avenue

Victoria, BC, V8R 1C4