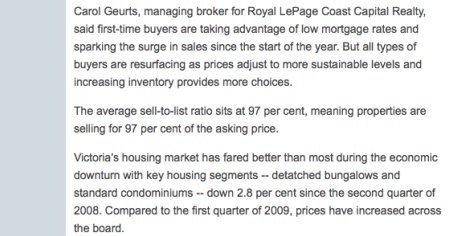

I was featured recently in the Time Colonist. The article was about the importance of having a home inspection. If you are buying a home in Victoria or on Vancouver Island, a home inspection is a must. In the article below I mentioned a buyer who decided not to continue with fulfilling her Contract of Purcahse and Sale on a condo mainly because of the opinion of the home inspector. It turns out that the inspector was right. After approximately six months the building envelope for the condo building was a problem. She was glad that she walked away from that offer.

You can read the full article below or contact me if you have questions about home inspections in Victoria.

Inspecting the inspectors

How to make sure the self-described expert you hire to examine a home really knows what he's doing

By Pedro Arrais, Times Colonist

Few home buyers today would consider purchasing a new residence without a home inspection. Nobody likes surprises, especially nasty ones. But unless they live in British Columbia, most buyers need to put as much effort into checking the qualifications of their inspectors as they put into ascertaining the condition of their intended purchase.

British Columbia is the first, and only, province in Canada to license home inspectors.

A home inspection is not a mandatory but a highly recommended step to uncover hidden problems. Armed with a written report identifying cosmetic and serious problems, prospective buyers can then make better informed buying decisions.

While the home inspection business has been active for the last 20 years, there is no national licensing program nor any federal regulations.

That has meant that anybody with a ladder and flashlight could set up shop and advertise his or her services as a home inspector.

"There have always been standards of practice," says Owen Dickie, president of the Canadian Association of Home and Property Inspectors (CAPHI), who represents over 250 members in 125 communities. "But adherence to them was never compulsory. The industry has taken a giant step forward with the adoption of legislation to license inspectors in B.C."

House inspectors in B.C. now have to take schooling, pass exams and be subject to peer reviews of their skills and qualifications. They undergo a criminal check and must carry liability insurance.

As the average selling price for a home rises in B.C., there is more at stake. The burden becomes higher for home inspectors as a more sophisticated public demands more accountability in case they purchase a house that later turns out to have a fault an inspector has missed, says Don Ruggles, owner of Sherlock Home Inspection in Victoria.

Errors and omissions can occur because inspections are only visual and non-invasive -- meaning an inspector cannot drill into walls to inspect hidden areas.

"High professional standards can reduce, but not eliminate, error," Dickie says. "Being members of a professional association gives the public an organization to address complaints."

The association requires members carry liability insurance to ensure protection to the consumer.

Since the legislation was passed last April, Dickie says there have been fewer complaints. Most complaints were about the quality of some work -- and most of the unsatisfactory work was done by incompetent and unqualified inspectors.

Although home inspectors have limitations on what they can do, they aren't daunted by those limitations.

"Problems make themselves apparent," Ruggles says. "We develop skills, much like a doctor, to diagnose and identify problems around a house."

He says stains, patches and unevenness in the walls, ceiling and floor of a house tell him a lot. They speak of structural failure, bad workmanship by tradespeople, water intrusion, drainage problems and insect activity. Sometimes they are evidence of renovations by previous homeowners with some great ideas, enthusiasm but not much skill.

Ruggles is also on guard against signs of illegal activity. The inhabitants of some houses have not been people, but marijuana plants. Growers have been known to modify the houses to promote plant growth -- resulting in problems with moisture and mould that require extensive renovation.

Ruggles says it's not uncommon to uncover issues with the house that the homeowner wasn't aware of.

"People don't usually inspect their crawl space or go up into their attic for no good reason," says Ruggles, who has over 15 years experience in the industry. "Many homeowners find out about problems only when they decide to sell."

Local inspectors know what to look for in their geographic area. For example: examining a residence for a leaky rainscreen is a must on the West Coast -- although it affects all of B.C. The same goes for good drainage to take all the rainwater away from foundations.

Other areas have other problems. Inspectors are on the lookout for subterranean termites and radon gas in the Interior and freezing clay in the North.

"Buildings will react the same (to wear and tear) given the same set of conditions," Dickie says. "But they don't face the same conditions across B.C."

The $350 to $500 fee charged by a home inspector can pay for itself very quickly when a potentially expensive problem is unmasked.

"I had a client who collapsed a sale on a condo because the inspector warned her he had concerns about the building envelope," says Brenda Russell, a Realtor with Royal Le Page Coast Capital Realty.

"We [the buyer and I] had our suspicions, but we weren't really sure. But we withdrew our offer. Within six months the building was diagnosed as being a leaky condo with a hefty bill for all the residents."

She says a home inspection is a standard clause on real estate purchase agreements. If a buyer wishes not to have an inspection done, he or she must waive the clause. Banks usually require an appraisal but not a home inspection.

While not as common, sellers also use home inspectors to assess the condition of their house in order to correct problems ahead of putting it on the market or to price it appropriately to reflect work needed to be done.

"As a realtor, I can advise and recommend, but an inspection report helps the buyer and seller decide for themselves," Russell says.

parrais@tc.canwest.com

© Copyright (c) The Victoria Times Colonist